If you haven’t already filed your taxes it’s time to get started. We’ve already looked at a collection of do it Tax software and services to help you file your taxes without spending a lot of time or money. We were able to catch up with Bob Meighan, TurboTax CPA & VP, to get the straight answers on how you can tell if you are able to deduct your notebook, iPad, smart phone and technology services on your income taxes.

If you haven’t already filed your taxes it’s time to get started. We’ve already looked at a collection of do it Tax software and services to help you file your taxes without spending a lot of time or money. We were able to catch up with Bob Meighan, TurboTax CPA & VP, to get the straight answers on how you can tell if you are able to deduct your notebook, iPad, smart phone and technology services on your income taxes.

For the most part technology purchases can only be deducted by small business owners and freelancers, but if you meet a few conditions you may be able to deduct the price of the iPad or cell phone you bought for work.

The Long and Short of Deducting Technology on Your Taxes:

If you are a small business owner or freelancer, you need to ask if the purchase was justifiable and reasonable in order to help you make a profit.

If you are an employee you need to ask who’s convenience the technology is for. If it is for your convenience, then you can’t deduct it. If the purchase is for your employer’s convenience, then you should be good to go.

How to tell if you can deduct your notebook, tablet or gadget:

According to Meighan the key criteria to decide if you can deduct a technology purchase is to ask yourself if the device is, “reasonable and necessary” for your business. As Meighan explains, the IRS has no explicit guidelines defining reasonable and necessary, and since the IRS is not unreasonable, at least in this area, if you use common sense you should be OK with deciding what to deduct. One thing that Meighan was quick to mention is that deducting an item like this is not a “red flag” on your account, that would make you more likely to be audited.

Tips for tracking your technology purchases for deductions:

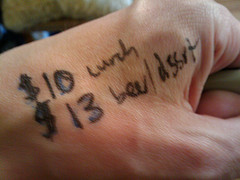

Just like with any deduction you’ll need your receipt to write off a purchase. In addition to keeping your receipt you should take a minute to write what it is used for on the actual receipt, just like you would write who you took to lunch and why on a lunch receipt. This Meighan recommends this practice not only for your records, but also to show the IRS that you are diligent.

After writing on your receipt, we recommend scanning it into a tool like Evernote or Springpad so that you can always find it. The digital copy will suffice for IRS needs in case you lose the original. If you want a full fledged tax and small business solution, check out Neatworks which offers scanners and software that track your expenses and can create reports from your scanned receipts.

Best way to write off your technology purchases:

When you are ready to write off your technology purchases, Meighan recommends that most of our readers write off the entire amount in the year the money is spent as opposed to depreciating over 5 years. The reasoning behind this advice is to take the maximum amount of deductions to offset your profit in the year that the expense occurred. For more information on writing off your expenses, check out the details of IRS Section 179.

Can Employees Deduct the cost of an iPad, smartphone or other device?

In most cases, employees cannot deduct the price of the iPad they bought so they could check their work email from the couch, because the gadget is for their convenience, not the employers convenience.

However, if your employer requires you to purchase some piece of technology or recurring service to be on call or always available you can deduct the price of your iPad, smart phone or cell service because the purchase was for the convenience of your employer, not just for your convenience.

Images via Flickr – David Reber and Inha Leex Hale